This weekend, the US Senate is taking up the new Inflation Reduction Act (IRA), moving it ahead under its special “budget reconciliation” process that will preclude any filibuster from opponents. After months of delays and painstaking negotiations, our own New York Senator Schumer, the Majority Leader, has closed the deal with his colleagues, and it’s likely to pass in the next few days. After that, it will be quickly taken up by the House of Representatives, which will consider via special proxy voting procedures since they have already recessed for their August summer break, and then go to President Biden for a signing ceremony.

We and our partners and allies in Health Care for America Now’s New York State Network have spent the last 18 months engaging with our state’s two senators and House delegation. Our goal has been to make sure that good stuff got into this bill and that bad stuff was kept out, and that sufficient savings were created and revenues raised in fair and just ways to pay for all the bill’s provisions.

While we didn’t get everything we were all pushing for from the outset of our efforts, what has made it to the finish line for health care is all good, and lays out a foundation to build upon going forward. As is always the case in legislative advocacy, what didn’t make it this time, we take forward into coming election seasons and congressional sessions – our work continues and we fight on.

Here’s what the IRA does to improve health care:

- Requires Medicare to negotiate to lower prices for high-cost prescription drugs, including insulin.

- Creates rebate penalties on drug corporations when they raise their prices above the general inflation rate.

- Caps the amount of co-pays that people on Medicare Part D have to pay for medicines at $2,000/year.

- Caps the monthly co-pays for insulin to $35 per prescription.

- Makes all vaccines free for people on Medicare.

- Expands eligibility to Medicare Part D’s “Low Income Subsidy” (aka “Extra Help”) to more low-income people.

- Slows the annual growth of Medicare Part D premiums.

- Continues for three more years the expanded health insurance premium subsidies for people and families who buy their own coverage on the Affordable Care Act online marketplaces (here in New York: “New York State of Health”.)

The IRA’s tax fairness provisions include:

- Creating a minimum corporate tax of 15% on booked profits, as part of an international agreement among the G20 nations.

- Creating a new 1% excise tax on corporate stock buybacks that are used to inflate stock prices and dividends for shareholders and corporate CEOs.

- Providing more funds to the IRS to go after ultra-rich tax cheats who don’t pay their fair share or what they owe.

How New Yorkers can help get this bill over the finish line:

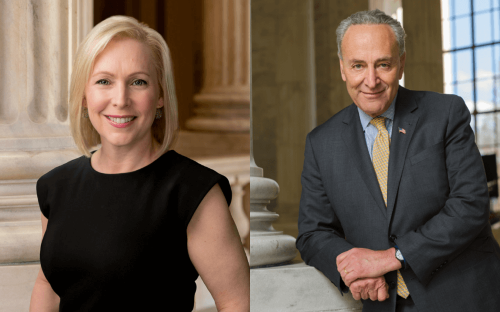

- Contact our two US Senators Schumer and Gillibrand to a) thank them for their leadership to get a final IRA deal negotiated with their colleagues, and b) get the job done over this weekend.

- Contact your own US Representative to urge they take up the IRA bill as soon as the Senate is done.

- Use phone, emails, and social media platforms to contact lawmakers and your own family, friends, and colleagues!

Many of the health care provisions in the IRA are historic. Because of everyday people pressure, Congress is finally poised to successfully take on and prevail over Big Pharma FOR THE FIRST TIME EVER! Needless to say, the drug industry is fiercely opposed to IRA, and is pulling out all the stops to protect their long-running price-gouging and profiteering. They are openly voicing threats to exact revenge on supportive lawmakers going forward. We all know that we here in the US pay way more for the same drugs than patients do in any other country, and that the drug industry is far and away among the most profitable in the world and has rigged the system in their favor for years.

Similarly, Wall Street is strongly opposing the IRA’s tax fairness provisions that for the first time in decades starts to close special tax breaks and loopholes that allow large corporations and the ultra-rich to avoid paying any taxes — again, because of people power. This too is historic, and again begins to turn the political tide on an industry long all-powerful in Congress.

It’s been a long haul to get to this point where some good things are about to get done, and some long-entrenched industries successfully challenged. We couldn’t have made it without your support and taking action. The IRA’s goals and provisions are VERY popular with voters despite being opposed by the vested special interests.