On Friday, December 4th at 12 noon, members of No Bad Grand Bargain (NBGB), a citywide network of health and social justice activists who focus on federal budget issues, and Americans for Tax Fairness (ATF), a Washington, DC-based coalition of national organizations who advocate for politically-progressive tax reform policies, are gathering outside the World Headquarters of drugmaker Pfizer in midtown Manhattan for a press conference and protest in reaction to the firm’s recently announced merger with Irish drugmaker Allergan.

“Pfizer’s Rx for America: Dodge U.S. Taxes, Stash Profits Overseas, Stick the Rest of Us with the Tab” will feature New York State Senator Liz Krueger, and speakers from ATF, UFT Retired Teachers Chapter, and Metro New York Health Care for All. The event will be held outside the company’s New York City office, located on the northwest corner of 42nd Street and 2nd Avenue.

Sponsors of the event include Citizen Action of NY, Fiscal Policy Institute, Democracy for NYC, Doctors Council/SEIU Healthcare, Metro NY Health Care for All, MoveOn, NYS Alliance for Retired Americans, No Bad Grand Bargain, Restore the American Promise, UFT Retired Teachers Chapter.

Pfizer’s merger with Allergan is a “corporate inversion” whereby Pfizer technically becomes an Irish-based company, thereby escaping paying U.S. corporate taxes, yet all-the-while maintaining its full U.S.-based operations and New York City headquarters. Such inversions are a strategy being increasingly employed by large U.S. firms to dodge taxes. Pfizer is one of the world’s largest and most profitable drug companies, in an industry that has one of the highest profit margins worldwide.

Tax dodging is nothing new for Pfizer. It hasn’t paid its full taxes in years by using a variety of business schemes. Meanwhile, it rakes in millions in profits by charging sky-high prices for its products, which forces up health insurance rates and rips-off Medicare, Medicaid, and other government programs. ATF recently released a report on the company titled “Pfizer’s Tax Dodging Rx: Stash Profits Offshore”, detailing a decade of nefarious tax activities by the company.

Many large corporations engage in a slew of scams to dodge U.S. taxes, and Pfizer is one of the worst offenders. When these companies don’t pay their fair share of taxes, the federal government doesn’t have enough money to pay for vital social and health care programs that many New Yorkers rely on to get by.

However, there IS some good news!

The “Stop Corporate Inversions Act” (S.198, H.R.415) in Congress will make it hard for large profitable companies like Pfizer to desert America for offshore tax havens, and will make large U.S. subsidiaries of small foreign parent firms pay its taxes if it is still managed and controlled from within the United States.

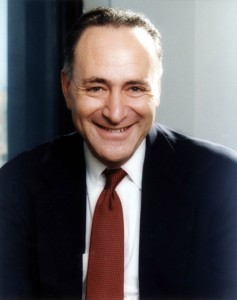

New York’s Sen. Charles Schumer can champion this bill and push it through by the end of this year IF he makes it a priority. There is a politically-viable “tax extenders” bill that Congress is likely to take up before it recesses for this year, and this new bill could be attached to it for easier passage. Sen. Schumer is the #3 Democratic leader in the Senate, and sits on the powerful Finance Committee. It is anticipated that he is likely to become Democratic leader in the Senate in 2017, and depending on how the 2016 elections go, will either be the chamber’s majority or minority leader.

NBGB is the local organizing affiliate of the statewide Restore the American Promise (RAP) campaign. NBGB, RAP, and ATF are together urging New Yorkers to contact both Senators Schumer and Gillibrand and their local members of Congress about the Stop Corporate Inversions Act within the next week. Congress is aiming for a December 11th recess, although it’s possible the may not finish up all their work for 2015 until sometime during the following week. In any case, there’s not much time.

Pfizer’s merger will not be completed until approved by the company’s stockholders at their annual meeting in the spring, so if this bill is enacted before then, it will make the firm’s proposed inversion much more difficult, if not impossible. Last year, drugstore chain Walgreens proposed an inversion, but it was stopped after much public outcry, so it is possible to stop them.